HOW TO RESTART YOUR RETIREMENT PLAN

A recent article on Fox Business reported shocking findings from the 2022 Fidelity State of Retirement Planning Study:

“More than 40% of the general population put their retirement planning on hold during the pandemic, and that number was even higher, at 55%, among young investors ages 18-35. In fact, nearly half of respondents from that next generation said they do not even see a point in saving for their later years until things return to “normal.”

Of the next-geners who quit their jobs during the Great Resignation and had a 401(k), 1 in 5, or 21%, cashed out their accounts after leaving.”

With the dislocations caused by the Covid lockdowns, this isn’t surprising to anyone. But as I read this article I thought to myself—OK, what’s done is done, but people can’t continue to stick their head in the sand and avoid any future retirement planning and investing, without a risk that they’ll wind up working for the rest of their lives. So what should you do now if you’re one of the 40% who pressed pause on your retirement plan, or the 21% of younger investors who cashed out your 401k plan?

Step #1–Go Back To Basics

Fortunately, retirement planning is basic math. You need to know what you have, estimate what you’ll be able to add to your existing investments, assume a rate of return on your current and future savings, and figure out where you need to be in the future.

If you’re in your 20s, 30s, or early 40s, and have 20-40 years or more until retirement, the good news is that even if you’re behind or just starting out/starting late, you’ll be able to catch up assuming you start to devote yourself to a disciplined savings plan and you invest well (more on this shortly)

If you’re in your 50s or early 60s, and this exercise reveals that you’re still quite a ways behind, you have fewer options to get back on track, but at least you know where you stand. Knowing is better than not knowing, because it means you can begin to take positive steps to improve your situation.

Older pre-retirees who aren’t on track to reach their goals with their current savings rate and a reasonable rate of investment return have three options: retire on less, save more money, or delay retirement.

For example, let’s look at a 52-year old with $250,000 saved who wishes to retire in ten years with a $1,500,000 portfolio, who is currently saving $1,000/mo and plans to increase that savings by 5% a year. At a 10% annual rate of return, they’re not going to get there. In 10 years, if all goes according to estimates, they’ll only have $880,000–barely half their target.

But if they can work another five years, retiring instead at 67, they’ll have achieved their $1.5M savings goal. If, instead, they can save $4,000 per month (and increase that by 5% per year) instead of $1,000, the $250,000 can balloon to $1.5M. Splitting the difference, our 52-year old would be able to retire in 12 years if they could save $2,500/month.

Getting back on track for retirement starts with a plan. Remember the Yogi Berra quote? If you don’t know where you’re going, you probably won’t get there.

Step #2–Invest Well

In Step #1, I assumed you would invest well, and applied a 10% long-term rate of return on your savings. As you might imagine, earning 10% a year over time is not easy, and even if you do everything right, you still might not achieve it if markets don’t cooperate. But there are decisions you can take to increase the odds that you’ll get a higher return on your savings. What are they?

First, invest all of your long-term savings in stocks, not a combination of stocks and bonds/cash or other assets like rental property, cryptocurrencies, gold, etc.

Which stocks?

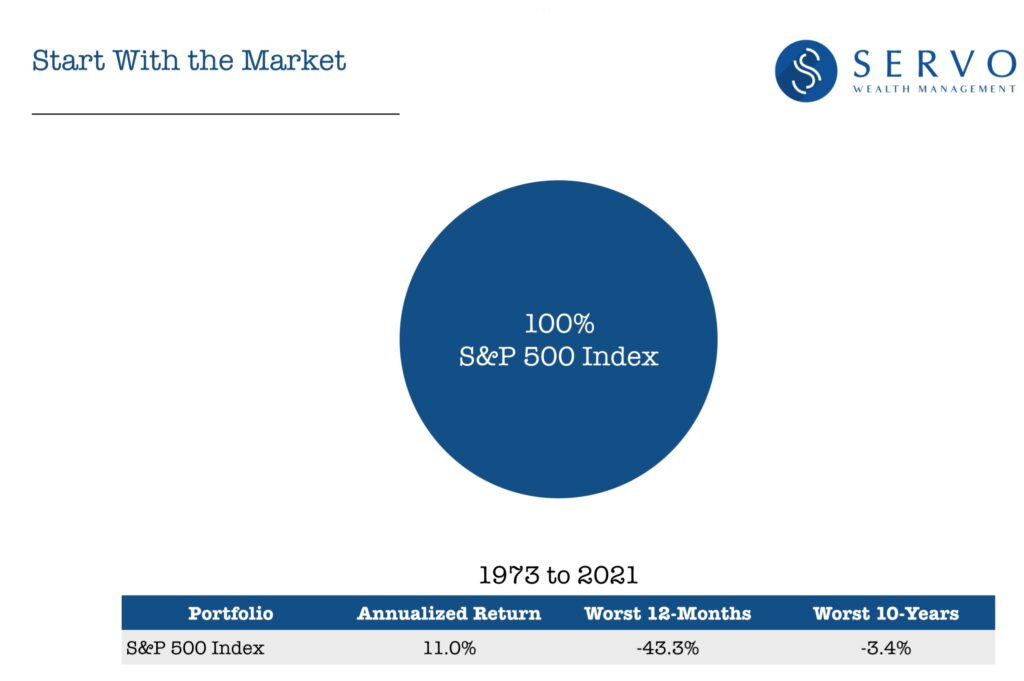

I would start with an index fund that owns large US companies. You’ll be spending most of your future retirement dollars in the US economy, so starting with the S&P 500 Index makes sense. Historically, the S&P 500 has had a return of almost +11% per year, but with a fair amount of short-term volatility. And even over 10-year periods, that 11% isn’t guaranteed. I would argue that going forward, we should expect a return of closer to +7% or +8% on the S&P 500.

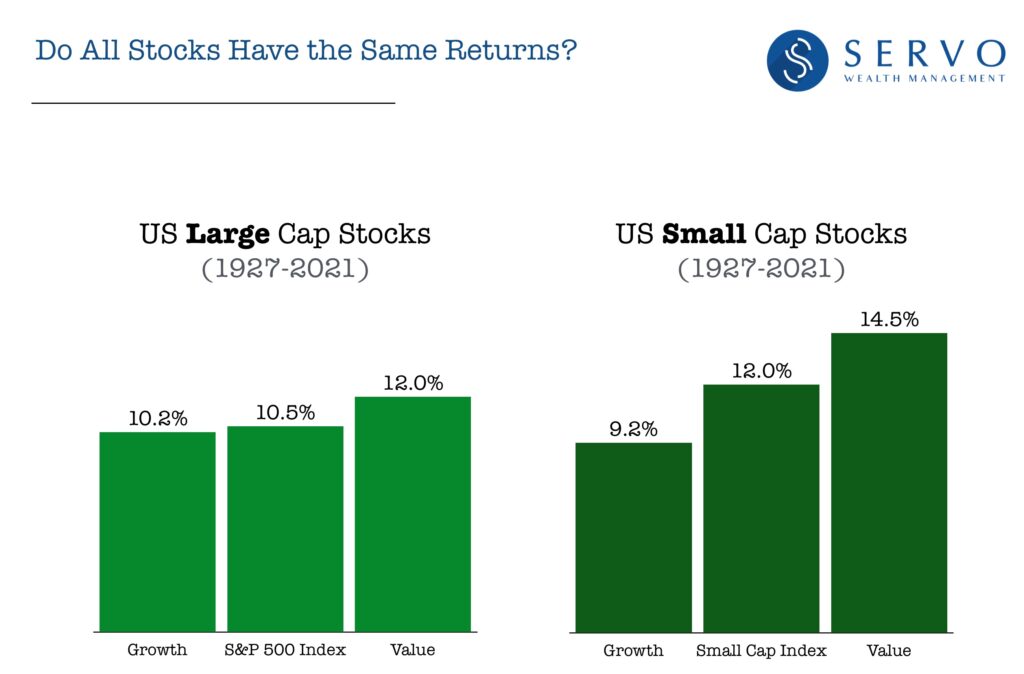

Next, I would look beyond US large cap stocks, first with stocks that are smaller and cheaper than the large high-priced companies that dominate the S&P 500. History shows us that small cap and lower-priced “value” stocks (think less glamorous banks, energy companies, pharmaceuticals etc. instead of high-flying tech stocks) have generated higher long-term returns. Small cap value stocks in particular have had much higher returns—over +14% per year for almost a century.

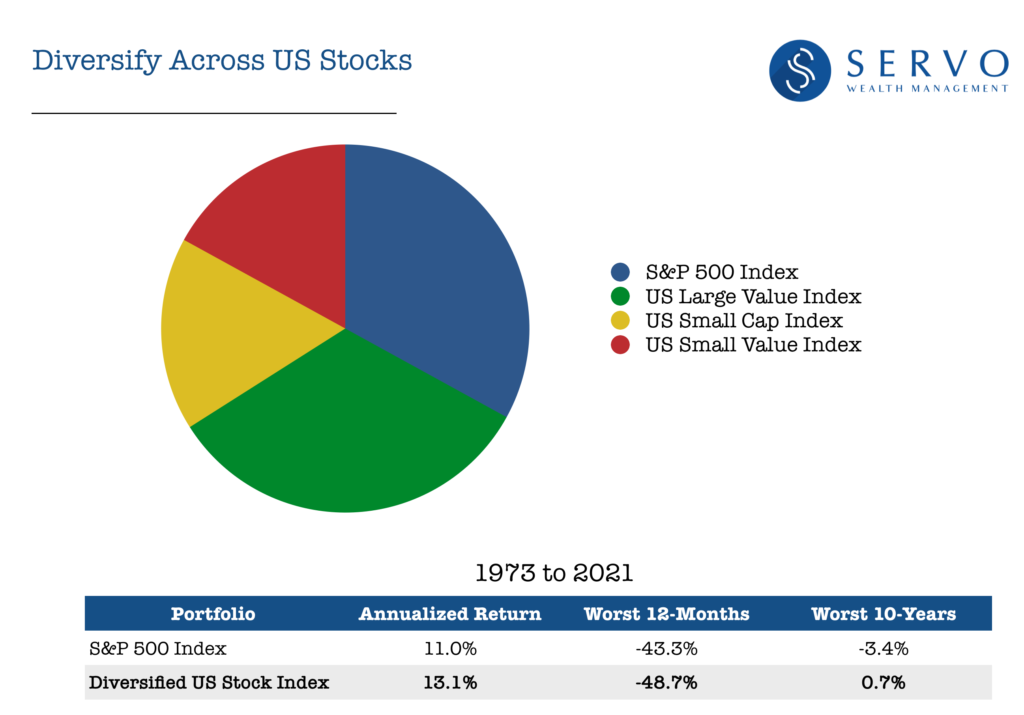

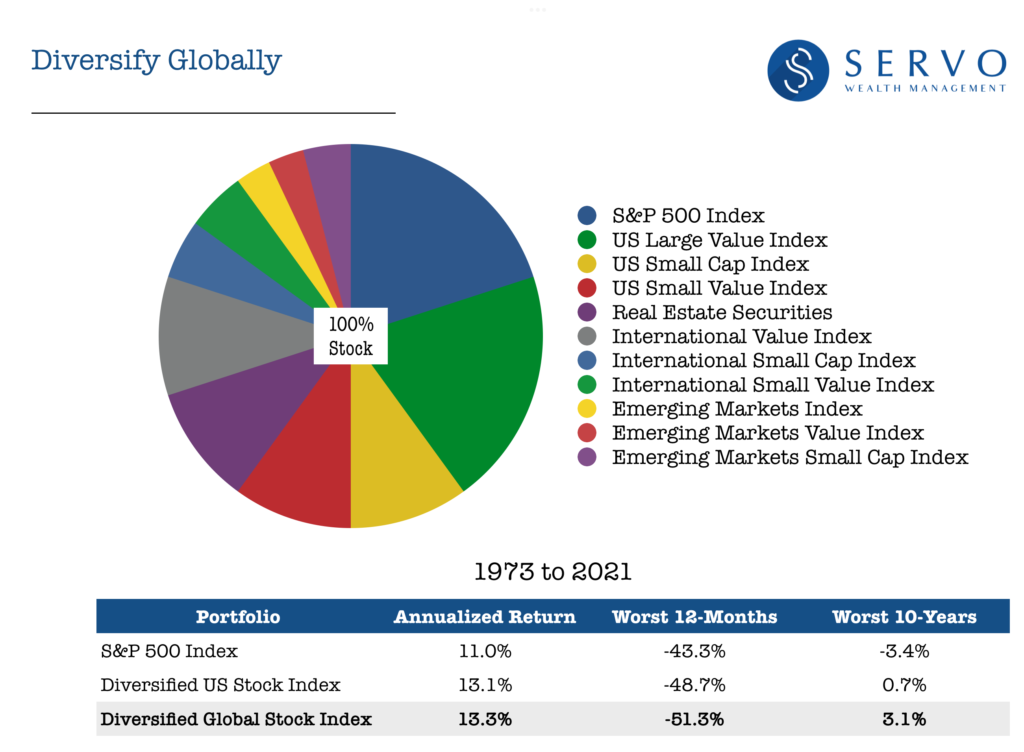

Splitting your stock allocation across large and small, growth and value stocks in the US has led to noticeably higher long-term returns with only a little more short-term volatility. Over longer periods, the added diversification is obvious—while the worst 10-year period since 1973 on the S&P 500 has been -3.4% per year, it was slightly positive for the Diversified US Stock Index.

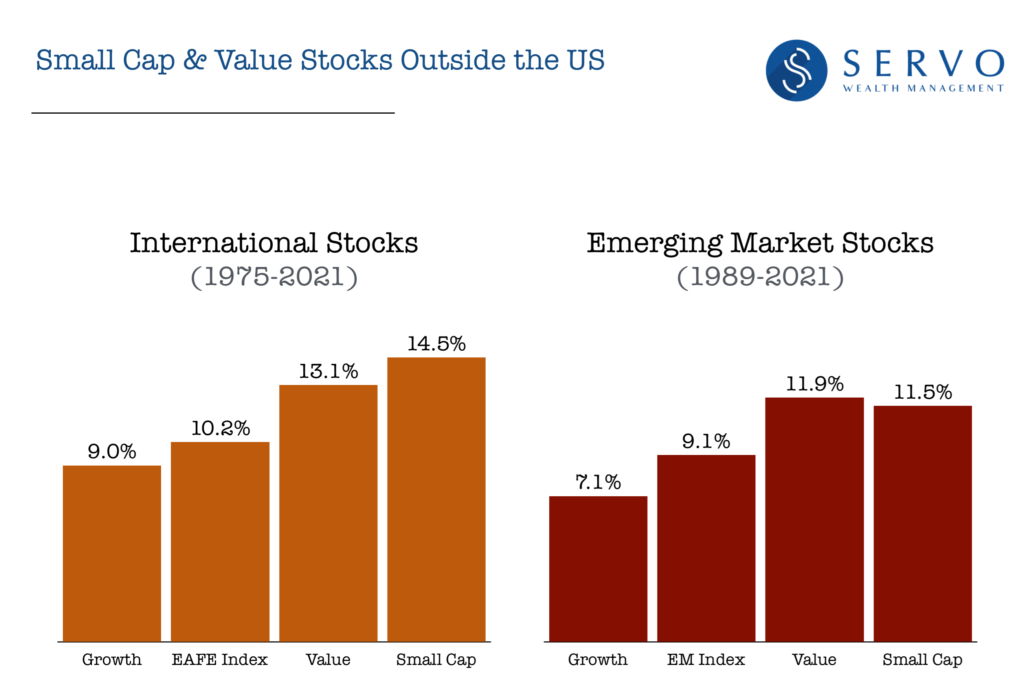

After diversifying across US stocks, I would then look overseas. Non-US stocks have similar expected returns to US stocks, but they move up and down at different times than US stocks and therefore provide valuable diversification. As with US stocks, international value and small cap companies have had much higher long-term returns than international indexes.

Seeing the small cap and value “premium” return show up in every region of the world for as long as we have data increases our confidence that we should expect higher future returns for owning these asset classes.

Non-US stocks outperformed US stocks during the 2000s decade and everyone wanted portfolios heavily tilted to international stocks. But non-US stocks have underperformed US stocks by as much as they outperformed since 2010, and now no one wants to own any. As with most decisions, moderation works best. The example portfolio below is the DFA (Dimensional) Equity Balanced Strategy Index, and holds 30% in non-US stocks. For most investors, this ratio of US to international stocks will work best.

The Dimensional Equity Balanced Strategy Index earned over 2% per year higher returns than the S&P 500—over +13% per year since 1973, and even slightly edged the US Diversified Stock Index despite the fact that US stocks outperformed non-US stocks over this period. Where the added global diversification really pays off is in the long term; the Global Stock Index’s worst 10-year return was a gain of +3.1% per year, +6.5% annually better than the worst decade for the S&P 500.

If stock returns are lower going forward than they’ve been in the past, this type of asset allocation—globally diversified with meaningful commitments to small cap and value stock asset classes—is, in my opinion, is the only chance there is to earn a +10%/yr long-term return. If you decide to invest differently, if you put all your money in large cap stock index funds (especially in the US) or water down your stock portfolio with bonds and cash, you’ll have to adjust lower your future expected returns by quite a lot.

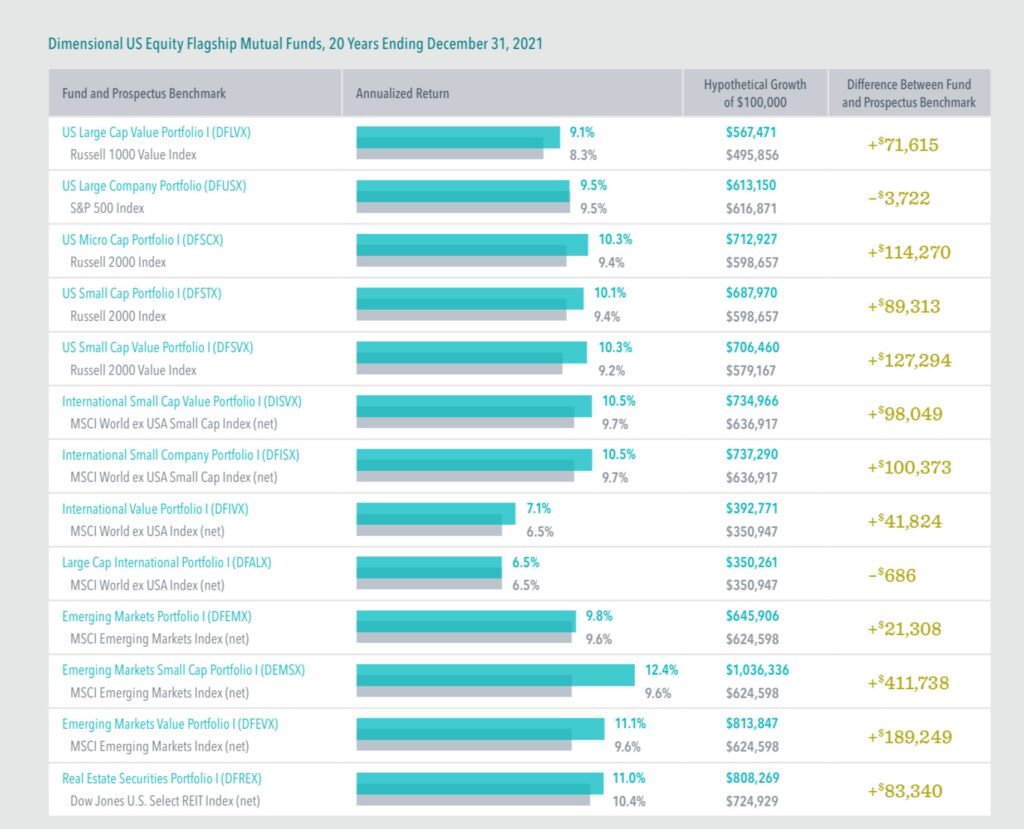

We’ve seen that owning a globally diversified, small/value tilted stock portfolio can lead to as much as +2%/yr higher long-term returns compared to a basic index fund. But the choice of funds that you invest in can also lead to a 1-2% higher or lower return.

The mutual funds and ETFs from Dimensional Fund Advisors are designed to consistently target the smallest and lowest-priced stocks, where expected returns are highest, and Dimensional manages their funds on a daily basis—patiently adding and deleting stocks that have recently entered or no longer deserve a place inside the parameters of the portfolio. While the details of Dimensional’s management are beyond the scope of this article, the benefits are easy to summarize.

The chart below shows that over the last two decades, Dimensional’s “structured asset class” approach to fund implementation has led to a significant advantage for almost every one of their funds compared to traditional indexes. If you are trying to get back on track for retirement, and earn the highest potential long-term return on your savings, you’ll want to invest in Dimensional funds and ETFs. Not iShares or Vanguard. Over time, the potential difference in returns can really add up.

Step #3–Don’t Shoot Yourself In the Foot

The last step once you’ve figured out what it will take and how to get back on your retirement track is to stay on track.

This sounds easy, but let me assure you it is not. As humans, we’re not hard wired to be good investors. A few weeks ago I wrote an article that suggested the biggest cost to investing was our own bad behavior—buying and selling our investments at the wrong time. The average investor has cost themselves almost -2% per year in the last decade simply by bailing out of their portfolio after it’s gone down, or piling more into investments and asset classes after they have recently had a big run up.

How to avoid shooting yourself in the foot? I have two suggestions.

First, stop paying attention to the financial media. Most of what they write is exaggerated and designed to invoke concern and fear. As the old saying goes—if it bleeds, it leads.

There is nothing in the financial headlines that you need to know to make good long-term investment decisions, but quite often a sensationalized headline might lead you to panic or give you a bad case of FOMO and cause you to make a bad investment move at the wrong time.

Read the sports page instead, or go read a book.

The second way to avoid shooting yourself in the foot? Don’t go it alone.

Working with a full-time, independent financial advisor has a number of benefits you may not have considered. First, simply helping you craft a plan and fully funding that plan can be quite valuable. Making sure you’re well diversified and also invested in the highest expected returning parts of the market, while minimizing unnecessary fees and taxes, can help you get further ahead. And finally, talking you out of panicking in tough times, or chasing the next hot investment scheme, can ensure you don’t lose so much of what you’ve worked hard to earn.

One of the fair criticisms of financial advisors in the past is that they have such high investment minimums that you need millions of dollars just to hire one. And if you’re trying to get back on your retirement track—you’re probably lacking the seven-figure portfolio to be considered.

But the good news is, with investment technologies continuing to advance—for example more modern custodians such as Betterment—and firms like Servo wanting to help more people who don’t yet have millions of dollars, you can now invest with an independent financial advisor with much less in investable assets than you used to have, and it’s easier than ever to get back on retirement track and stay on track.

If you have any questions about the steps I’ve outlined above, or would like to schedule a 30-minute window to chat with me about your retirement plan—whether you’re looking to get back on track or go from a good strategy to a great one—click this link to find some time when we can connect.

There’s no excuse to keep your head in the sand.

________________________________________________

Past performance is not a guarantee of future results. Index and mutual fund performance includes reinvestment of dividends and other earnings but does not reflect the deduction of investment advisory fees or other expenses except where noted. This content is provided for informational purposes and should not to be construed as an offer, solicitation, recommendation or endorsement of any particular security, products, or services.

Navigation

Home

Blog

Contact

Services

About

FAQs

Location

Newsletter

Our monthly newsletter, Words On Wealth (formerly Factors In Focus), is an essential part of our investment management and financial planning services.